GBP: Sterling malaise likely a sign of things to come

EUR: Uptrend firmly in place

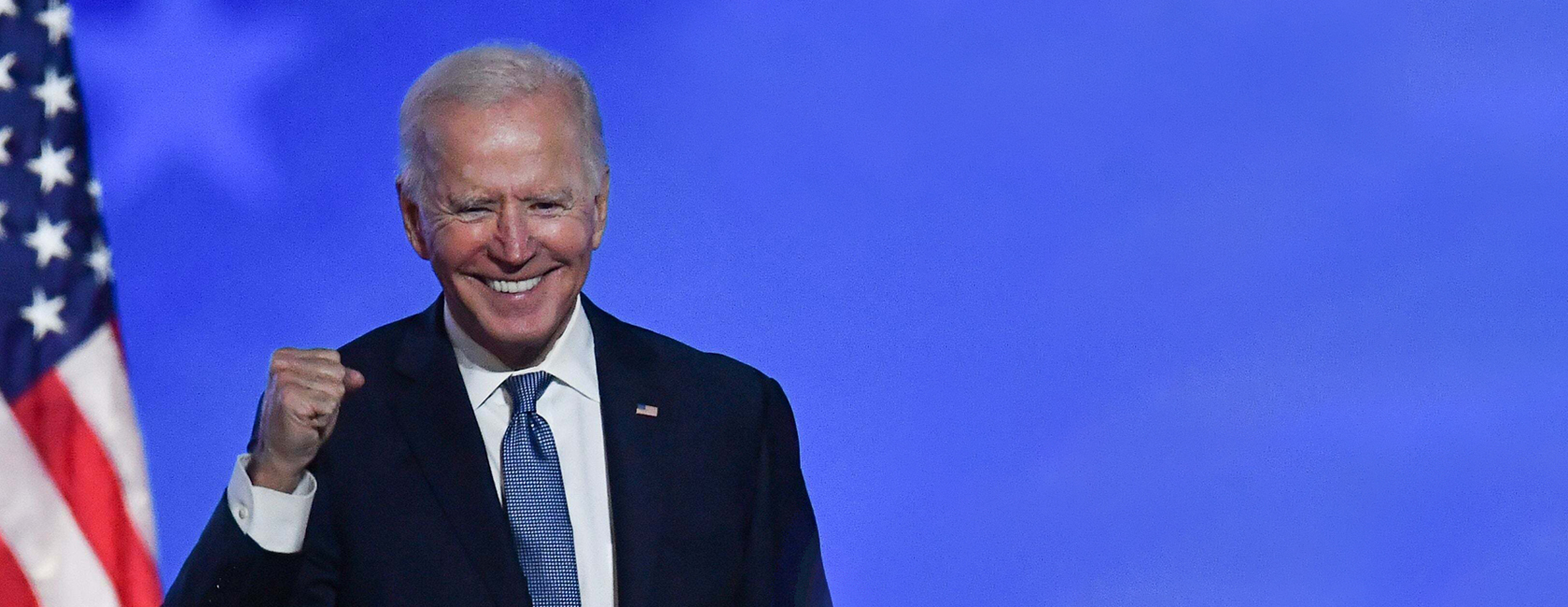

USD: Dollar needs Republican win to avoid falls

Sterling

Sterling has recovered some of its lockdown losses against the dollar this morning although this seems to mainly be a result of at least one of the two Georgia Senate seats being called for a Democratic candidate.

News on the ground in the UK is thin beyond businesses’ reaction to the lockdown and the subsequent new spending plans by the Chancellor. Businesses in leisure and hospitality will receive an extra £9k of support but the big guns of an extended furlough scheme or a business rates holiday have yet to be fired by Sunak.

Time will tell whether the UK will need more help from the Chancellor but with initial belief being that the PM’s 6 week lockdown pledge is optimistic and that something closer to 4 months may be needed, then businesses will need additional support.

With a Brexit deal announced just before the new year, we will be finally be able to run our webinar on what the deal means for you and your business. Next Tuesday at 11am we will take you through what you need to know when transacting with business in the EU, small print to look out for, how to protect your finances from swings in currency markets and where opportunities may lie in our new future outside of the European Union.

You can sign up here ( https://equals.email/t/5CSB-B32T-2VNLD7-7V1EQ-0/c.aspx ); registration is free but spaces are limited.

Euro

The strength of the euro will be a foundational story for the most part of 2021 we believe and the weakness of the USD overnight has gone a way to help that. Macroeconomic data however, is not having a great effect on currencies at the moment with only Covid hospitalisation figures and central banking actions seemingly mattering.

For now we remain confident in the euro uptrend.

US dollar

As it stands this morning, the two Democratic candidates for the US Senate are leading in the vote count to win the special election held overnight. This would be a notable polling surprise and could lead to a rapid reimagining of laws in the United States.

From a currency point of view, the dollar weakness overnight will likely continue; with a Democratic Senate, House and White House, Biden has the power of the ‘blue wave’ in his policy-making. This means higher taxes, greater spending and hopefully, greater global growth.

Both races are still too close to call, but 2021 may be starting with some dollar-funded fireworks already.

Elsewhere

With the trend of the USD decidedly uncertain as we wait on the news from the state of Georgia, emerging market currencies are happy to hang out and wait although most are higher this morning given the belief that the Democrats may be in for a double win.

Commodity currencies have also run higher after oil prices kicked above the $50 a barrel mark yesterday for the first time since February of last year.

Have a great day.